2022 tax refund estimator turbotax

If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan you will not be eligible to receive your refund up to 5 days early. Updated for Tax Year 2022 October 18 2022 0848 AM.

Turbotax Taxcaster 2022 2023 Free Tax Refund Calculator

Updated for Tax Year 2022 October 18 2022 1148 AM.

. Updated for Tax Year 2022 October 18 2022 0814 AM. The TurboTax TaxCaster is an all-in-one online tax tool that helps you work out a range of tax-related figures. After three years unclaimed tax refunds typically become the property of the US.

Updated for Tax Year 2022 October 18 2022 0935 AM. Written by a TurboTax Expert Reviewed by a TurboTax CPA. For tax year 2022 the Child and Dependent Care Credit adjusts back to the pre-2021 provision and changes back to.

You can use a W-4 Withholding Calculator to help you estimate what you should enter on your W-4 and adjust the amount that you can expect as a refund when you prepare your taxes. Your tax expert will amend your 2021 tax return for you through 11302022. Written by a TurboTax Expert Reviewed by a TurboTax CPA.

Approval and loan amount based on expected refund amount eligibility criteria and underwriting. Updated for Tax Year 2022 October 18 2022 1133 AM. Written by a TurboTax Expert Reviewed by a TurboTax CPA.

TurboTax free Canada income tax calculator for 2022 quickly estimates your federal and provincial taxes. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan you will not be eligible to receive your refund up to 5 days early. No later than May 31 2022 TurboTax Home Business and TurboTax 20 Returns no later than July 15 2022.

If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you. Written by a TurboTax Expert Reviewed by a TurboTax CPA. Audit Defence and fee-based support services are.

5-day early program may change or discontinue at any time. Updated for Tax Year 2022 October 18 2022 0705 AM. Your tax expert will amend your 2021 tax return for you through 11302022.

E-file online with direct deposit to receive your tax refund the fastest. For tax years prior to 2022 you should receive this form if your annual credit card processing activity exceeds 20000 and you had more than 200 individual transactions or in limited instances the sales volume is 600 or more per year. This free tax refund calculator can be accessed online and because you can use the calculator anonymously you can rest assured that your personal information is protected.

Written by a TurboTax Expert Reviewed by a TurboTax CPA. Up to 35 of 3000 1050 of child care expenses for a dependent child under 13 an incapacitated spouse or parent or another dependent so that you can work or look for work. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan you will not be eligible to receive your refund up to 5 days early.

Loans are offered in amounts of 250 500 750 1250 or 3500. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan you will not be eligible to receive your refund up to 5 days early. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan you will not be eligible to receive your refund up to 5 days early.

If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan you will not be eligible to receive your refund up to 5 days early. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan you will not be eligible to receive your refund up to 5 days early. Your tax expert will amend your 2021 tax return for you through 11302022.

Estimate your 2022 refund taxes you file in 2023 with our tax calculator by answering simple questions. Written by a TurboTax Expert Reviewed by a TurboTax CPA. Written by a TurboTax Expert Reviewed by a TurboTax CPA.

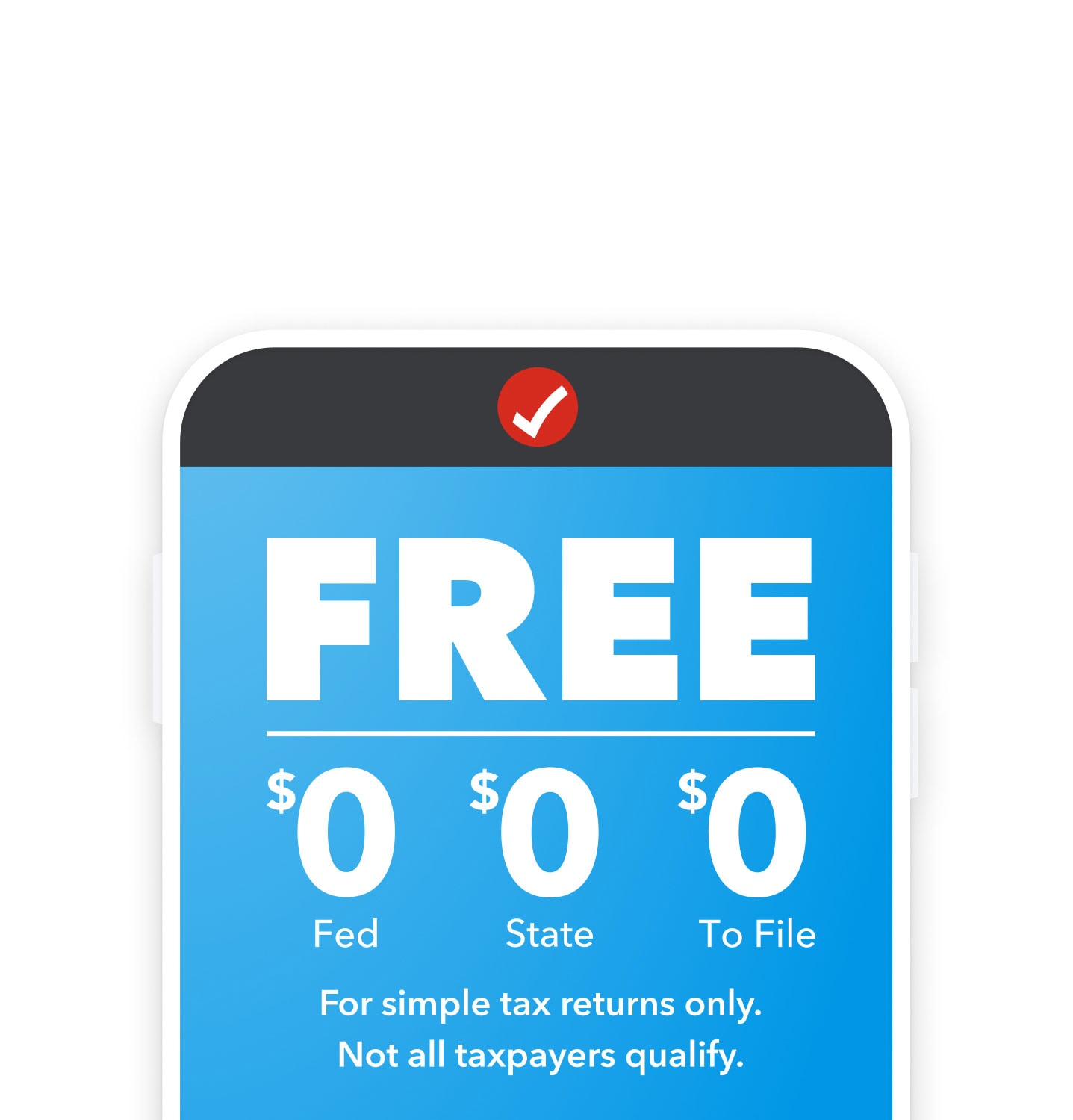

If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan you will not be eligible to receive your refund up to 5 days early. Updated for Tax Year 2022 October 18 2022 1223 AM. Try it for FREE and pay only when you file.

If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan you will not be eligible to receive your refund up to 5 days early. TurboTax online makes filing taxes easy. Lets look at TaxCaster and see how it analyzes your income and key tax factors to.

If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan you will not be eligible to receive your refund up to 5 days early. That means for 2022 tax returns the window closes in 2025. Updated for Tax Year 2022 October 18 2022 1142 AM.

Choose easy and find the right product for you that meets your individual needs. It is not your tax refund. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan you will not be eligible to receive your refund up to 5 days early.

Updated for Tax Year 2022 October 16 2022 1205 AM. Also here is information from the IRS on why your refund may have been adjusted. Your tax expert will amend your 2021 tax return for you through 11302022.

For answers to this question and anything else related to your tax situation TurboTax Live tax experts are available in English and Spanish year round and can even review sign and file your tax return. Written by a TurboTax Expert Reviewed by a TurboTax CPA. TurboTax is the easy way to prepare your personal income taxes online.

Generally you have three years from the tax return due date to claim a tax refund. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan you will not be eligible to receive your refund up to 5 days early. Claiming the Earned Income Tax Credit if you are eligible.

5-day early program may change or discontinue at any time. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan you will not be eligible to receive your refund up to 5 days early. Find out your tax refund or taxes owed plus federal and provincial tax rates.

Available in TurboTax Self-Employed and TurboTax Live Self-Employed. This is an optional tax refund-related loan from MetaBank NA. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan you will not be eligible to receive your refund up to 5 days early.

Written by a TurboTax Expert Reviewed by a TurboTax CPA. Tax Year 2022. 5-day early program may change or discontinue at any time.

5-day early program may change or discontinue at any time. Key Takeaways Choosing the filing status that best matches your situation can lower your taxes and increase your refund. If you filed an extension by April 18 2023 2022 tax year filing deadline.

5-day early program may change or discontinue at any time. 5-day early program may change or discontinue at any time. Your tax expert will amend your 2021 tax return for you through 11302022.

5-day early program may. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan you will not be eligible to receive your refund up to 5 days early. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan you will not be eligible to receive your refund up to 5 days early.

IRS Adjusted the Child Tax Credit on Your Return.

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Where S My Refund Tax Refund Tracking Guide From Turbotax

Free Tax Filing See If You Qualify Turbotax Free Edition

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Tax Calculator Return Refund Estimator 2022 2023 H R Block

Best Tax Software For 2022 Late Or Not Turbotax H R Block And More Can Help You File Cnet

Best Free Tax Software 2022 Free Online Tax Filing Zdnet

Tax Calculator Refund Return Estimator 2022 2023 Turbotax Official

How Do I Print Or Download A Return I Filed This Year In Turbotax Online

Tax Refund Advance Get Up To 4 000 Turbotax Official

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Turbotax 2022 Review Online Tax Software Leader Still Dominates Cnet

Taxes 2022 Irs Tax Deadline Is April 18 How To File Extension More

![]()

Taxcaster Tax Calculator On The App Store

Taxact Vs Turbotax 2022 Nerdwallet

1 Free Tax Refund Estimator In 2022 Turbotax Taxcaster

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter